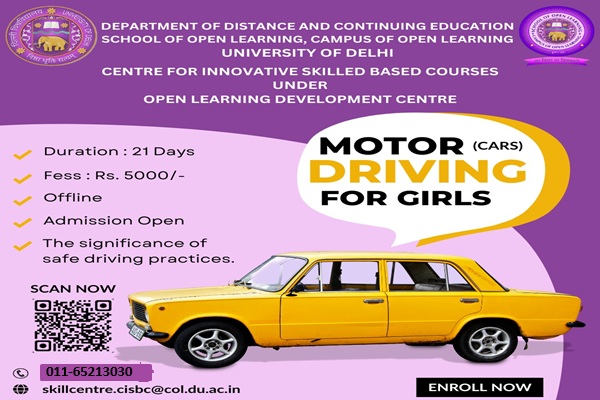

OPEN LEARNING DEVELOPMENT CENTRE

उत्तिष्ठत जाग्रत प्राप्य वरान्निबोधत

SCHOOL OF OPEN LEARNING, CAMPUS OF OPEN LEARNING

DEPARTMENT OF DISTANCE AND CONTINUING EDUCATION

UNIVERSITY OF DELHI

Certificate course in Basics of Accounting and GST

Help Desk

Contact Us

Email: skillcentre.cisbc@col.du.ac.in

Phone: 011-65213030

Phone: 011-27008300

Toll Free: 1800118301

For queries and suggestions please contact our helpdesk (Monday to Friday 09:30 AM to 5:30 PM):

Address: OLDC, Second Floor, ARC Building, University of Delhi, Opposite S.G.T.B. Khalsa College, Delhi-110007

About the Course

The "Certificate Course in Basics of Accounting and GST" is a structured two-month program that blends core accounting knowledge with practical skills in accounting software and taxation. This course covers essential topics such as basic accounting principles, financial statement preparation, and hands-on training with Busy and Tally software. It also provides in-depth learning about GST, including registration and tax management processes, and teaches how to integrate GST compliance into accounting software. Additionally, participants will gain experience in inventory and payroll management using accounting software, enhancing their ability to manage day-to-day business operations. Upon successful completion, participants will receive a certificate from the School of Open Learning, University of Delhi, which will enhance their professional qualifications in the field of accounting and finance.

Mode of Classes

Offline

Duration

2 Months 16 Hours (2 Hours Class per week)

Fees

6000

Eligibility

12th pass in any stream.

Schedule Of Classes

16 Hours (2 Hours Class per week)

Assessment

|

MCQ-Based Assessment |

(50 Marks) |

|

Viva |

(20 Marks) |

|

Assignment/Project |

(20 Marks) |

|

Attendance |

(10 Marks) |

Time Table

|

Days of Week |

Class Timing |

Location |

|

1st Batch Saturday 2nd Batch Monday & Wednesday |

10:00 A,M to 12:00 P.M(1st batch) |

OLDC, Second Floor, ARC Building, University of Delhi, Opposite S.G.T.B. Khalsa College, Delhi-110007 |

|

Commencement of Classes

|

Admission Open for 3rd Batch.

|

Disclaimer *

- All rights related to skill courses structure and time-table are reserved by the Centre for Innovation and Skill Based Courses(CISBC), OLDC.

- Schedule of every skill based course being offered is subject to the number of enrollments per course.